Jun 28, 2017

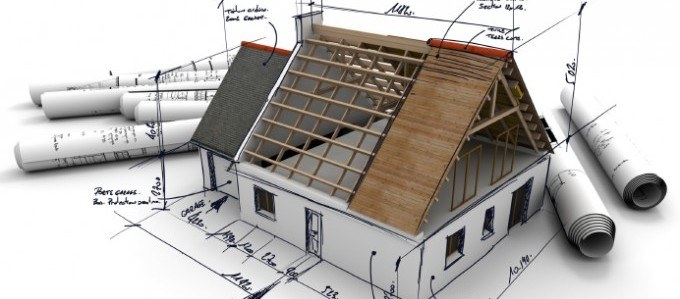

Party Wall etc Act 1996, what it does it mean to you?

Being aware of the 'Party Wall etc Act 1996' and the implications it may have on your property development is crucial.

Jun 28, 2017

Being aware of the 'Party Wall etc Act 1996' and the implications it may have on your property development is crucial.

Whether your plans are to renovate a property into your dream home, or if you see renovating as an investment, to disregard taking insurance cover can prove to be a costly oversight. This should really always be in place before the renovation work starts.

However what this article is highlighting is that it isn’t just your own building that you should be thinking about. Depending on the property being renovated, you need to make sure all your bases are covered, and this includes structural warranty and insurance to cover any accidental damage that might occur to any neighbouring properties.

Why is party wall cover so important?

Party wall insurance is a type of cover specific to renovation projects which have a boundary wall that is used by a neighbour as well as the renovator, so there is more than yourself involved; leading to you being liable for any potential damage that may occur.

If you’re about to embark on or are in the process of renovating, you should check if obligations under the Party Wall Insurance Act (1996) apply to you and whether or not you have ticked all the boxes. Working with renovation insurance experts will help ensure you don’t miss anything out. The right specialists can take care of the cover to dovetail with your existing liability insurance.

As the owner of a property undergoing renovation, you are required to give notice to your neighbours one or two months in advance to outline your planned works. You would also have to appoint a party wall surveyor to make an inventory of the condition of neighbouring properties prior to you starting work.

The main reason for this is to make sure you are not held liable for any defects that are already present in your neighbour’s property.

The unpredictable nature of renovation work means you need a safety blanket and are required to take out party wall insurance in the name of you and your contractor to cover yourself for any damage that may occur to the neighbouring property as a result of the works.

To disregard party wall insurance is a big risk that could stop you from carrying on with your plans. Ultimately, this is a risk not worth taking!

For business or private client insurance solutions, please get in touch